Best volume indicators for analyzing day trading trends

It will be seen that in day trading, volume indicators are very important in evaluating the market trends to make the right decisions. Volumes assist a trader to identify changes in trends, breakouts, and the strength of the price movement. Thus, by combining volume indicators with technical analysis, the trader can improve his/her approach to trading and reduce possible losses. Thus, in this article, the author aims at discussing the most popular volume indicators of day trading and describing how they operate, why they are important, and how traders can apply this knowledge to make the right decisions.

Understanding Volume Indicators in Day Trading

What Are Volume Indicators?

Volume bars or volume indicators are indicators in technical analysis that work as the number of shares, contracts, or units that have been traded in a specific period. To this effect, these indicators aid the trader in establishing the strength of the prices within the market. Higher volume is considered strong market interest, while low volume is viewed as weak market interest. As compared to prices, indicators based on volumes add further weight to a particular trend. This is because understanding the function of volume indicators will enable the trader to eliminate noise and increase the accuracy of the trade. When used together with technical indicators, they enable one to identify breakouts, trend reversals, and entry or exit signals while trading.

Why Volume Is Crucial in Market Trends?

Volume is a critical factor in defining the sustainability of the trends prevailing in a certain market. Volume is a measure of buying or selling activity; therefore, when the price rises and this is supported by volume, then the trend is authentic. On the other hand, the price movement with low volume is likely to have a short-term effect or not be strong enough. Volume also assists traders in identifying when a particular trend is about to reverse due to differences between price movement and volume. For instance, if price is moving up while the volume is coming down, this may be an indication that the price trend is about to reverse upwards. Volume indicators help traders to observe the patterns of trading, which in turn enable them to make sound and accurate trading decisions on time.

How Trading Volume Affects Price Movements?

It means that trading volume directly impacts the price because it considers the participation of the markets or the level of liquidity. In high volume, there is a sign of strong buying or selling, and therefore, this causes the prices to shift more significantly. Trading at low volume also tends to cause sideways movement or fakeouts. Volume indicators help in providing support to the identified price patterns, as a higher volume strengthens the breakout or the continuation of the trend. For example, an upward breakout with volume is a good sign of the continued buying pressure, while a lower volume after a rally is a sign of weakening of the upward pressure. Trading volume gives traders the means of distinguishing between the strength and weakness of a price trend.

Top Volume Indicators for Analyzing Market Trends

On-Balance Volume (OBV) for Trend Confirmation

On-Balance Volume (OBV) is one of the volume indicators calculated based on momentum that provides information about buying and selling pressure by summing volume at higher prices and subtracting the volume at lower price levels. OBV rises when there is a bullish signal while it declines in the case of a bearish signal. OBV is therefore employed by traders to identify divergences between price and volume which may lead to a change of trend. For example, when the price is moving up and OBV is moving down, this is a clue that the buying pressure is not very strong and the price may be due for a reversal down. OBV makes it easier for traders to establish the momentum of the market, therefore making it easier for one to determine the best time to trade and increasing the accuracy of the trade.

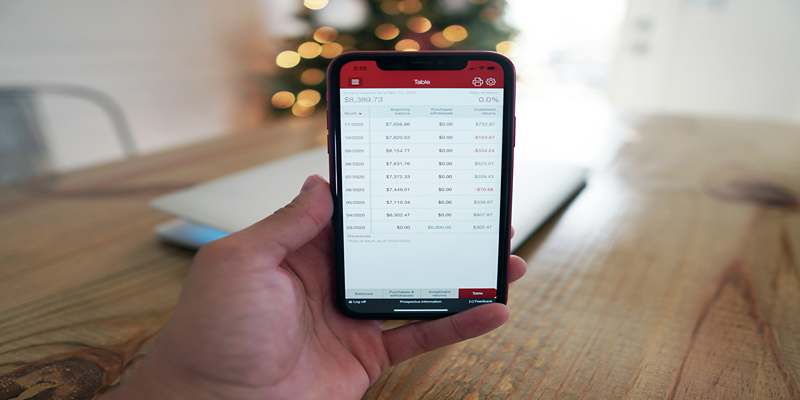

Volume Weighted Average Price (VWAP) for Entry and Exit

Volume Weighted Average Price (VWAP) is a stock volume indicator that is used to find out an average price of a particular asset traded in the market during a certain day. It offers a reference point for institutional traders and gives day traders the right entry and exit signals. Whenever the price is above the VWAP, then this signifies a bullish pressure, while if the price is below the VWAP, then this implies bearish pressure. VWAP helps traders in determining the conditions of the market and prevents them from making poor entries in the trade. It is also used as a dynamic support and resistance level for refining a trader’s decision-making and management of risks within a day trading business.

Accumulation/Distribution Line for Market Sentiment

The Accumulation/Distribution (A/D) Line is a volume bar chart of the rate of money flow into or out of an asset. This includes the use of price and volume to establish which side of the market is dominant, that is, if a stock is being bought or sold. An ascending A/D line suggests the presence of buyers, while a declining A/D line suggests that there are sellers in the market. This one enables traders to understand if price trends have corresponding volumes within the stock market. If the prices increase while the A/D line decreases, it can also signal a reversal to assist the traders in determining when to enter or exit the market.

Conclusion

Volume bars are among the most useful tools that any day trader should use to analyze the markets and make better decisions. The combination of OBV, VWAP, and the A/D Line helps the trader to get more information regarding trading volume and price. These indicators assist in establishing the trends, identifying when the trend has reversed, and when to adjust a trade. Volume is used together with other technical tools in an attempt to reduce risks and to increase the profits of the trader. The knowledge of how volume indicators work in the market makes a trader better able to make trades since it will enhance the trader’s performance in day trading. Monitoring volumes on a frequent basis is much more accurate to make better decisions and thus, more profitable trades.